Embedded with AB to ship a disruptive fund analytics platform from scratch

Overview

AllianceBernstein wanted to offer their clients easy-to-use tools to quickly address complex questions. One of the first in the line up was Alphalytics. We helped the AB team define, design and ship this disruptive product.

Outcome

To measure the progress of Alphalytics, Bernstein created an advisory board of representatives from the world's leading institutional asset owners and users.

Words from Robert van Brugge, CEO, Bernstein Research

"Since rolling out the tool last year, we've seen steady client demand and believe that our research and product roadmaps have set us up on the right path to innovation as we continue to evolve the offering to better service our users."

You can read more about its impact on the official press release here.

Discovery

Using a primary persona to guide and de-risk decisions

We identified asset managers as the primary persona. Our discovery work validated key insights into the primary personas motivations:

They are most worried about their performance + getting fired

They are very concerned with staying competitive

This product can help them show off when they are performing, and help them if they are not.

The opportunity

Asset managers live under intense pressure to perform. They're motivated to try anything that gives them an edge.

AllianceBernstein spotted an opportunity: build a product around idiosyncratic alpha - a deep measure of weighted performance that no competitor offered. Screening thousands of funds, peer comparisons, diagnostics to understand why one fund outperforms another.

Bringing design thinking to institutional finance

This product didn't exist anywhere else. Idiosyncratic Alpha was a brand new measure. We speak design and product, so we used visuals to figure out the shape of the product, quickly picking up new language (and acronyms!).

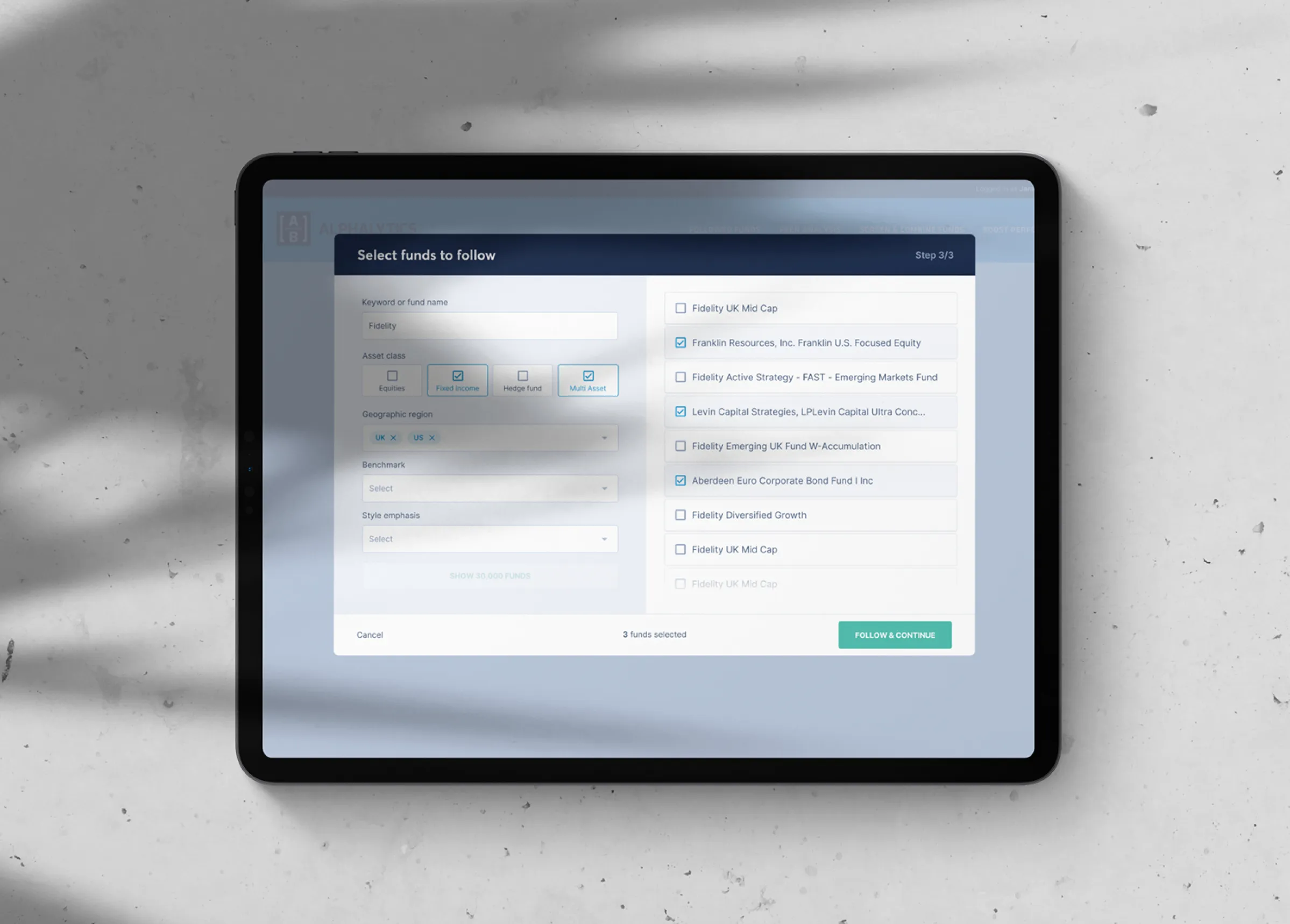

The first step was helping asset managers quickly find and follow funds.

Instant value

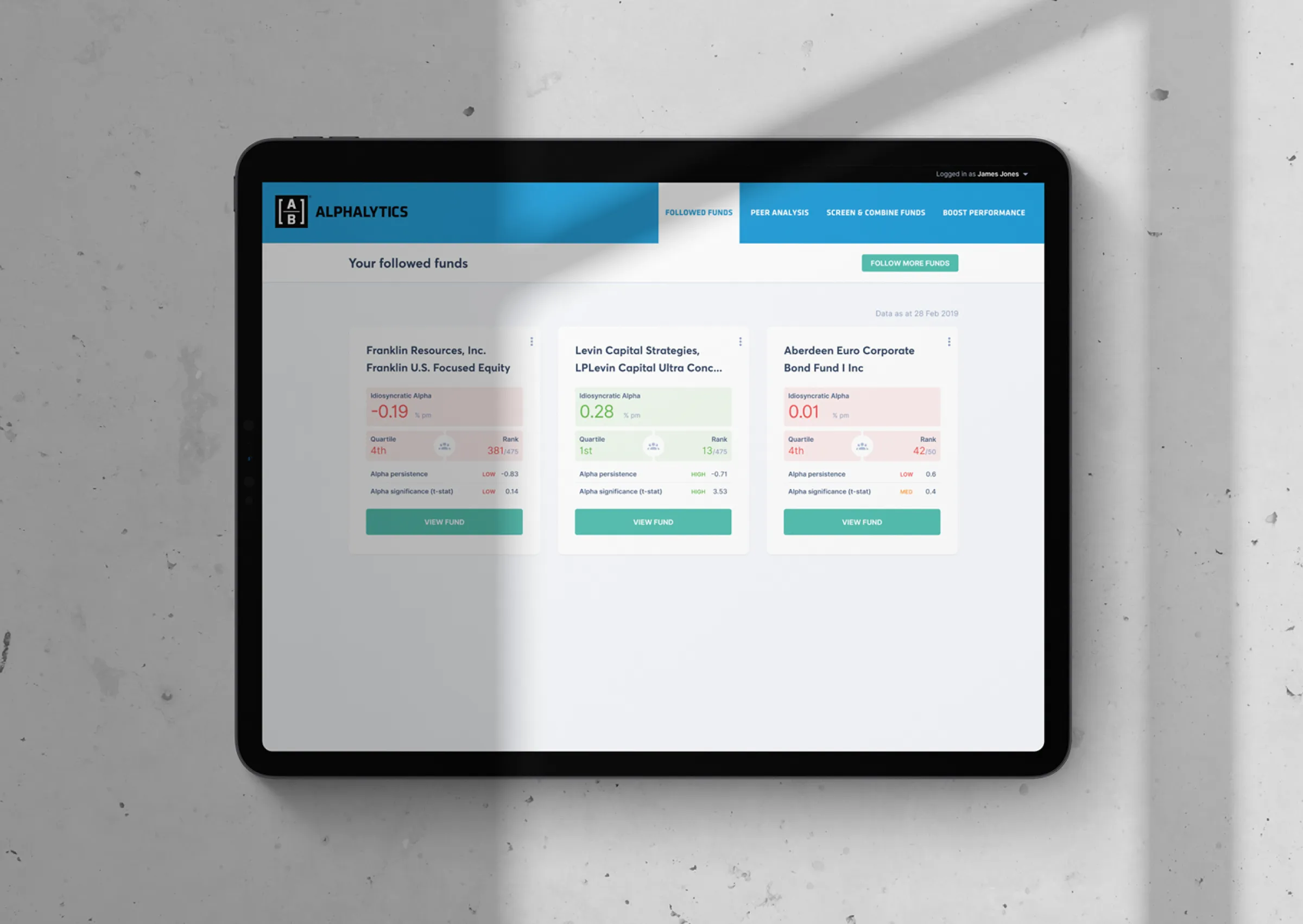

They'd then quickly see each fund compared at a high level.

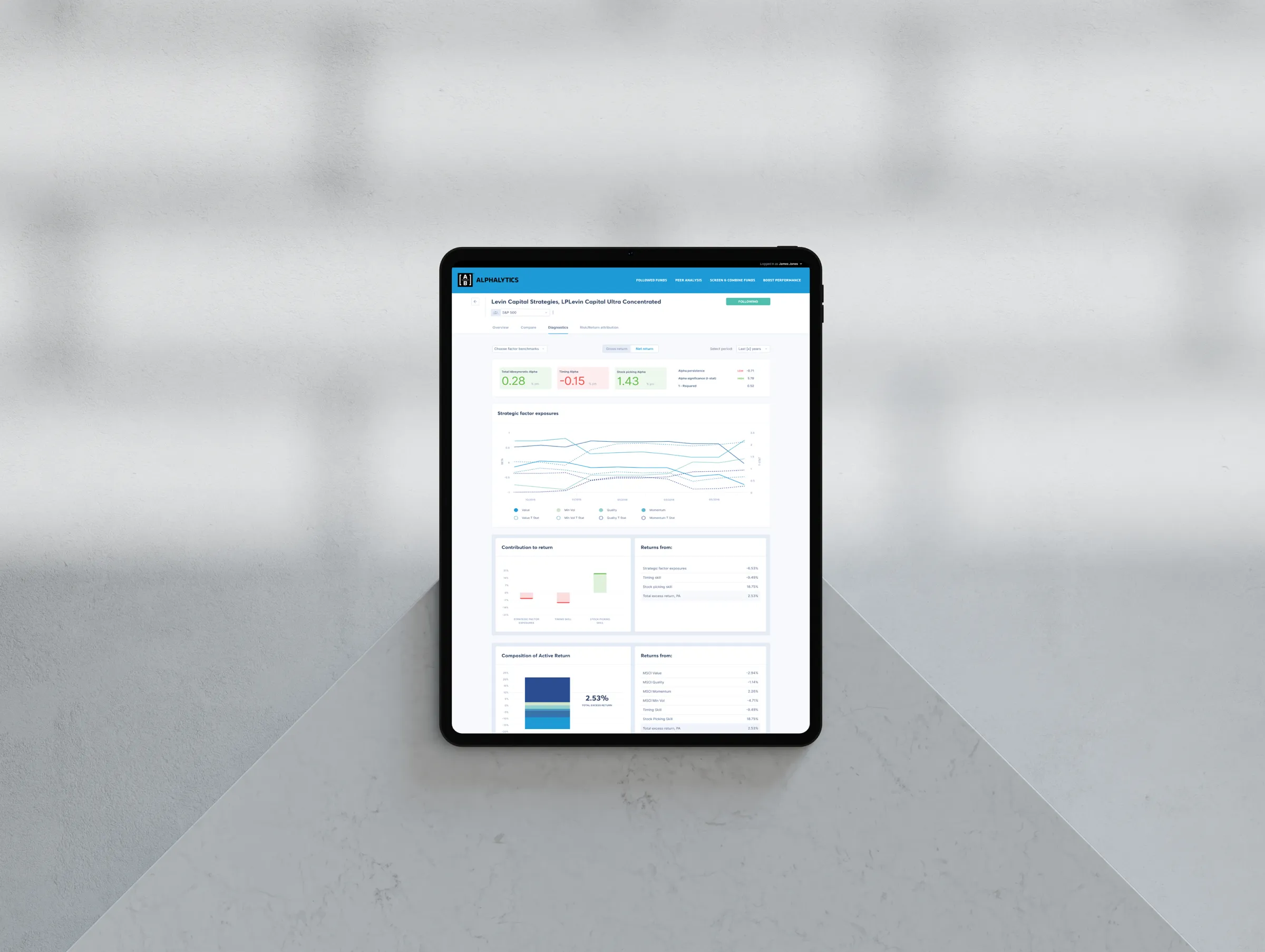

Run diagnostics on each fund

Quickly and easily run diagnosis with live data feeds and charts that show key measures and benchmarks.

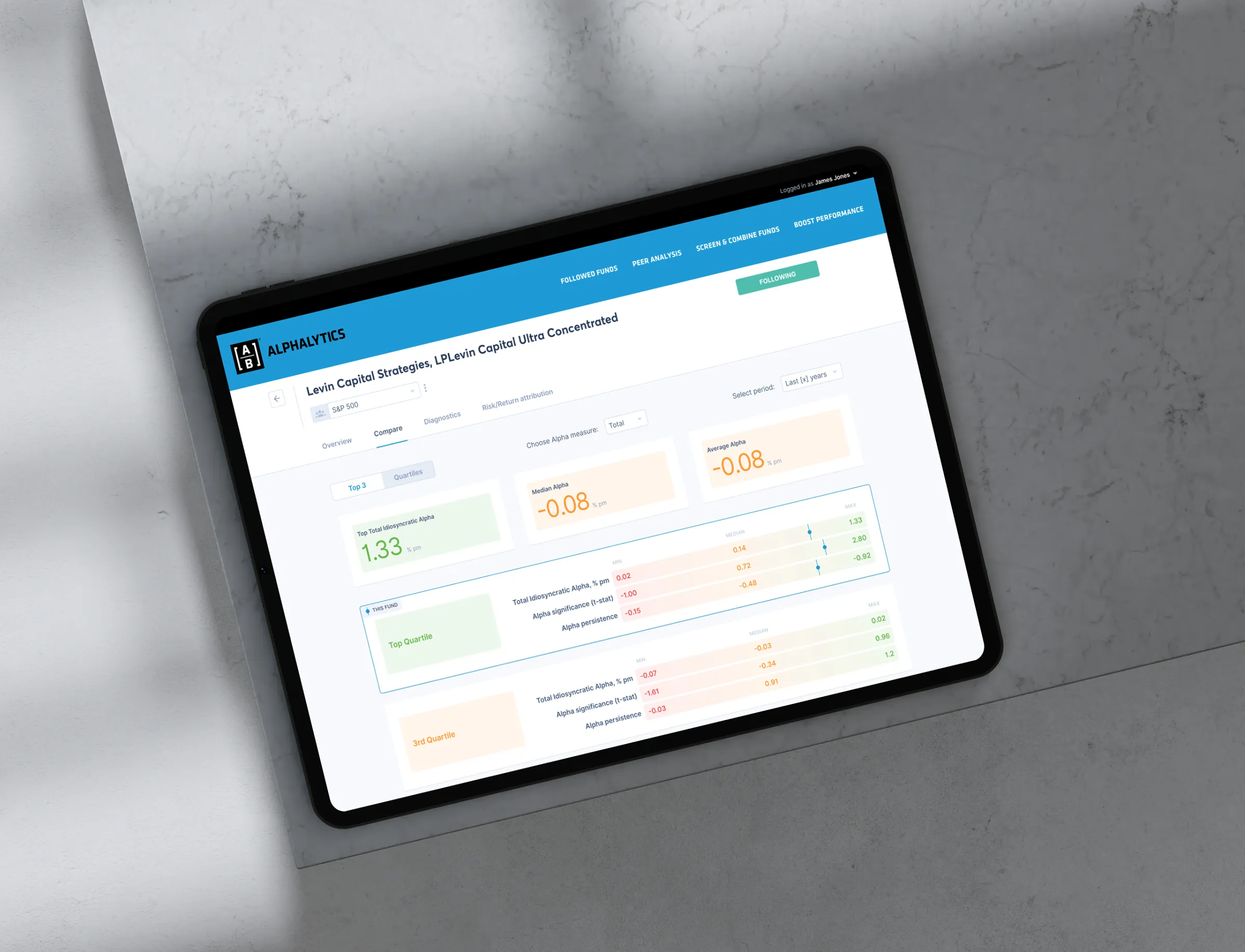

Then compare how each fund compares to its peers

Using different Alpha measures, time periods and quartiles

As well as correlation analysis

Choose peers and run various types of analysis for deep granular details. We used a consistent heat mapping colour system throughout the product to enable asset managers to get insight from a quick scan.

The transformation

We proved design thinking works in institutional finance. They proved they could trust designers who didn't speak finance fluidly to deliver. So much so we worked with them in a number of other departments and initiatives over the course of 2 years.