Co-creating the global payment standards to reduce checkout friction across billions of transactions

EMV® 3DS needed to validate authentication flows that would directly impact conversion rates across billions of online transactions. Payment authentication creates friction at checkout; the exact moment when cart abandonment peaks at 70-82%.

Banks, card networks, and merchants worldwide required data-driven evidence that proposed authentication standards would reduce friction while maintaining security, balancing conversion optimisation with fraud prevention across 6 markets.

The work

Research-Driven Testing at Scale

Designed and iterated 80 authentication flow variants across 6 markets

Built custom prototype tool that streamlined testing logistics—allowing rapid iteration based on user behaviour and insight data

Applied CRO methodology to payment security: every design decision validated through user testing, not assumptions

Translation to Business Impact

Converted complex technical requirements into clear UX standards that balance security with conversion:

Reduced authentication friction points that typically cause checkout abandonment

Created guidelines enabling consistent implementation across thousands of merchants

Established testing framework for ongoing optimisation as technology evolves

Industry-Wide Conversion Impact

The resulting standards now shape authentication experiences affecting billions in transaction volume. By applying conversion optimisation principles to security flows, the guidelines help merchants maintain checkout conversion rates while meeting regulatory requirements.

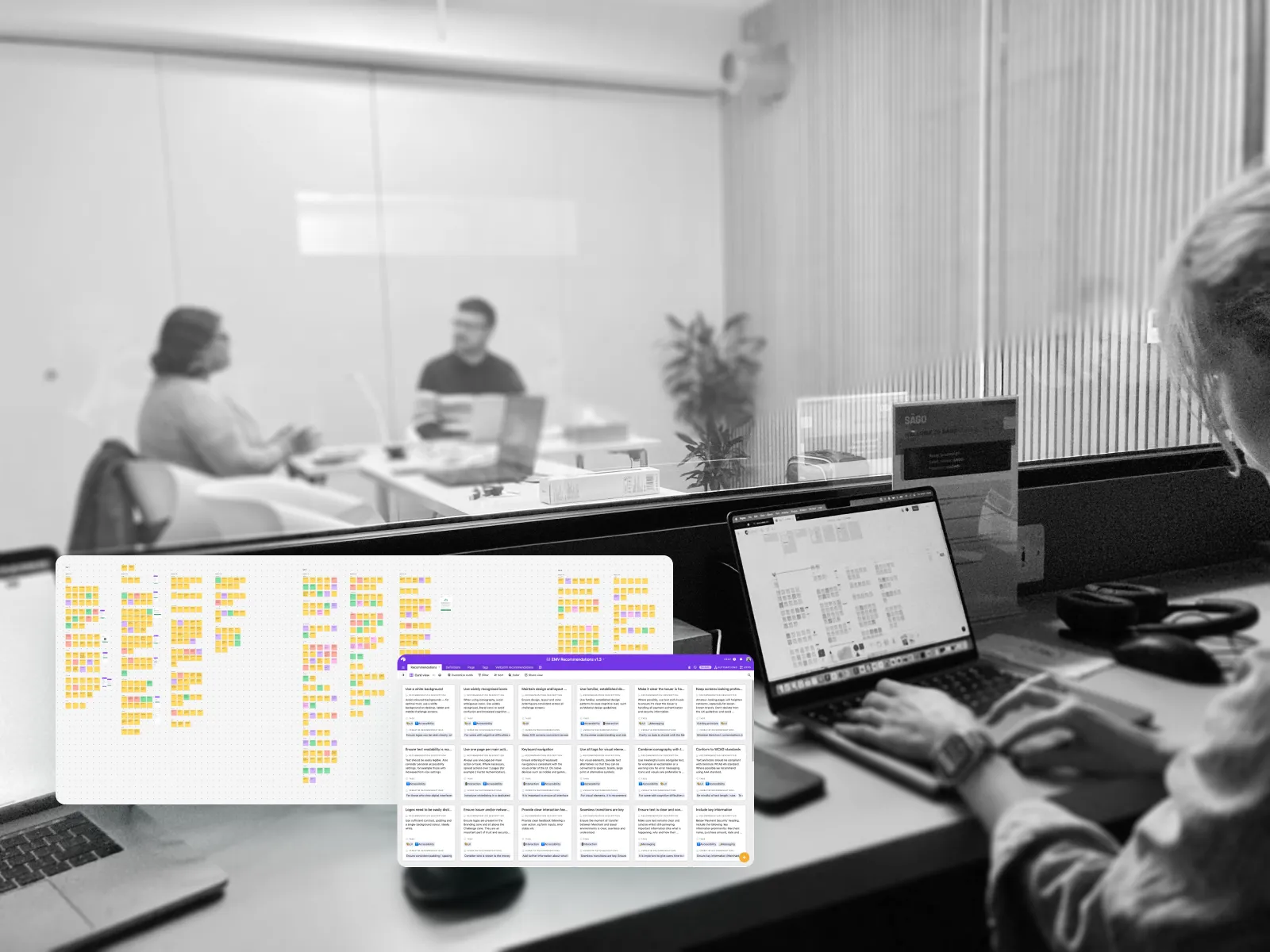

Early alignment (with visuals) is key

In our first collaborative workshop we co-created each and every variant, including new features and UX enhancements. There were many flows and complex use cases to cover, so visual journey maps helped bring alignment quickly.

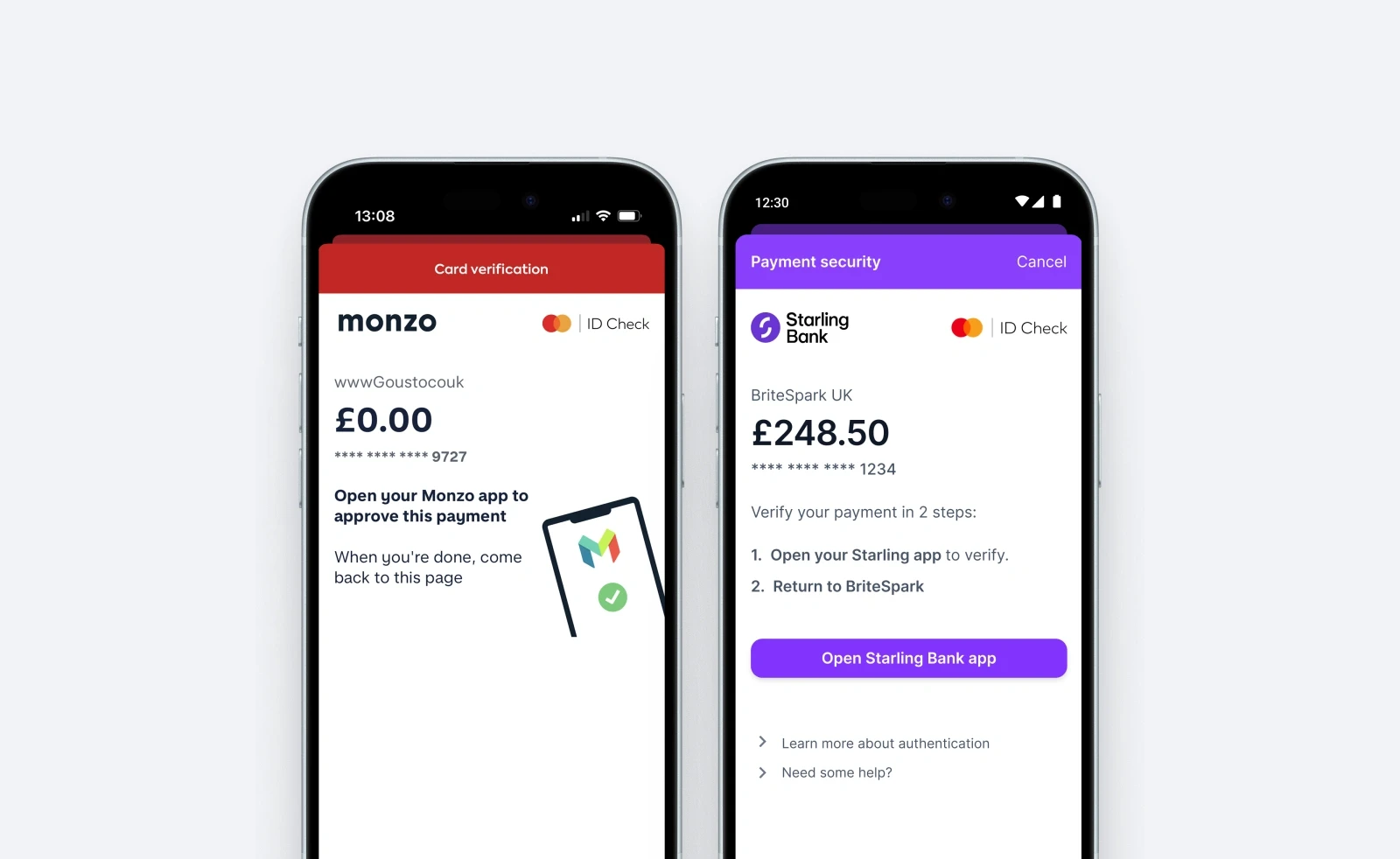

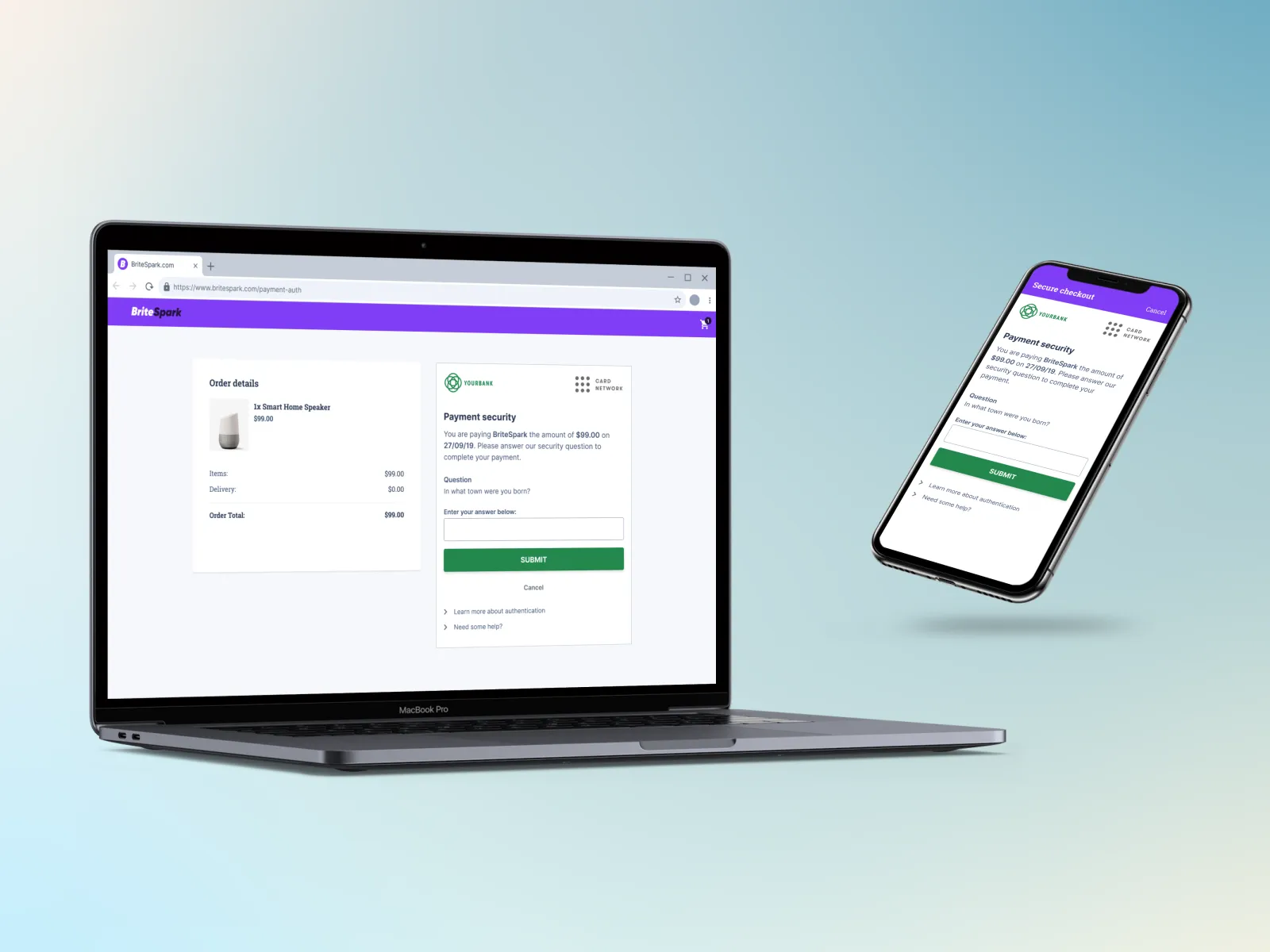

Customers trust brands they recognise. So we had to invent fake ones.

In order to simulate more realistic payment anxiety

We combined translation AI with Ipsos' local market translators

Once we had designed and built the prototypes for each flow we combined human and AI to translate every word. This was done with a combination of components and variables. The user testing team in each market then made sure the AI translation had captured the nuance of their language.

The payment flows had to work identically whether you're a fintech in Singapore or a high-street bank in Munich.

So we used consistent template-based approach in Figma.

The template also had to work across all devices and in multiple languages, from iFrames to native experiences

Payment authentication happens across all kinds of devices, including gaming consoles like Xbox. Each prototype was designed and built according to these specs to ensure a seamless experience.

Making life easier for researchers

Each researched needed easy access to each flow. So we built a flow variant hub along with a pre-agreed codename for each variant. We also included things like secret hit spots to reset each prototype.

Even the smallest UX copy can make or break a conversion, especially when something unexpected happens

Small copy tweaks made all the difference at this scale. Small changes can be a challenge to keep track of across multiple markets. Variables made this manageable as one change in one place updated that change across all flows.

And as we tested, we captured insights into Figjam, sometimes iterating between participants

We captured every design change in Figjam and ported all insights across to Airtable to share with the wider teams. We used coloured sticky notes to make insights scannable in Figjam.

Making the findings accessible

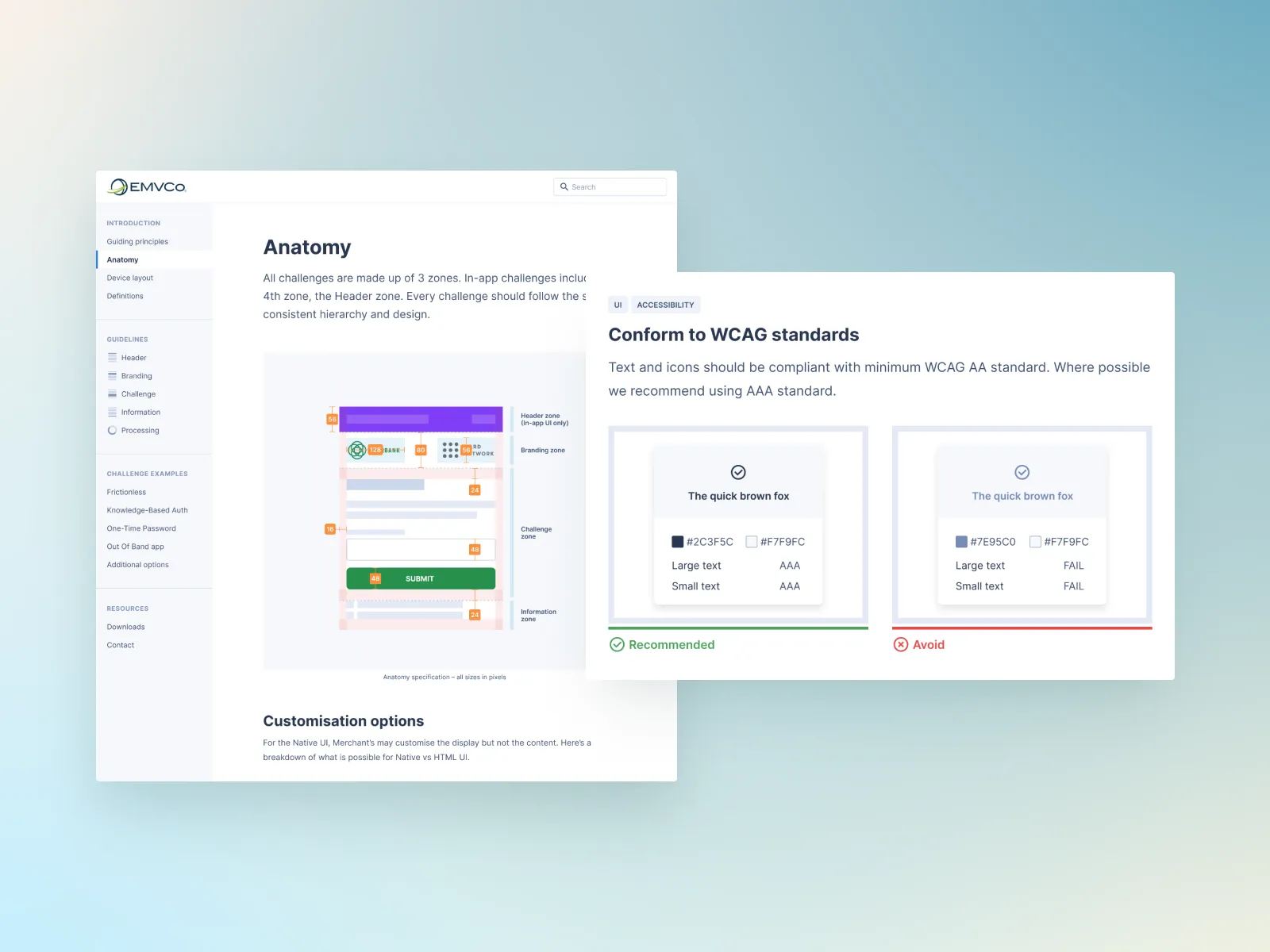

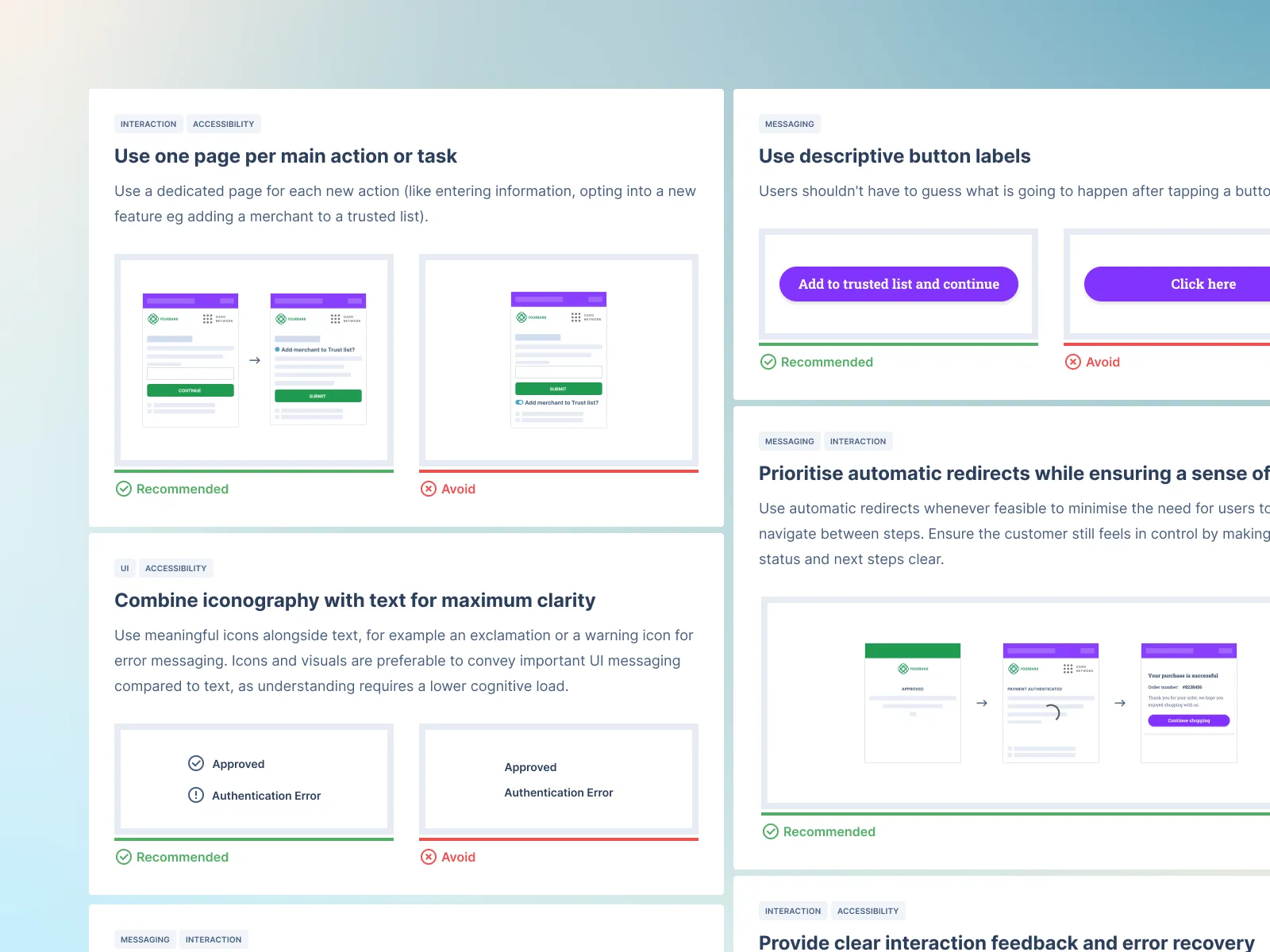

This amount of research created a lot of data. To make it easy to digest, we built and co-authored the 3DS UX guidelines. What was once trapped in PDFs was now brought to life with easy navigation and interactive prototypes.

We then combined 16 months learnings into an interactive online guide to make the insights accessible to all.

Live prototypes, visual examples and clear recommendations for specific use cases made for a smooth, engaging UX.

Key Insight

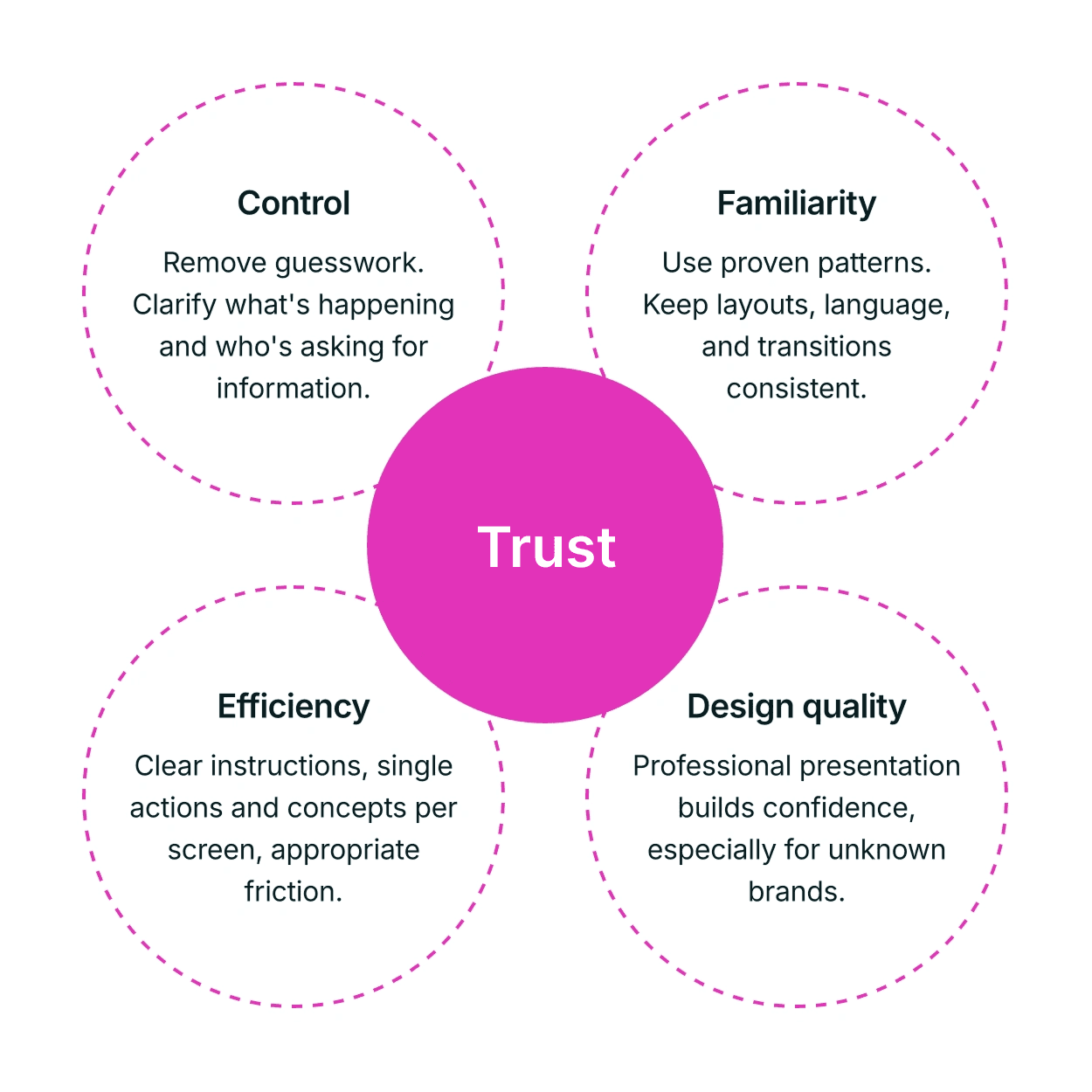

Balancing friction with efficiency can increase conversion, especially when security is top of mind.

To satisfy the needs of:

banks that want to protect their customers

merchants that want to maximise sales

card networks that want a bit of both

We came up with 4 pillars, driven by the research (both qual and quant)...

4 Conversion Pillars: